Marry the House, Date the Rate?

Let's talk about that ubiquitous real estate mantra: "Marry the house, date the rate." It sounds charming, right? But it feels more like cheesy pep talk and it lacks grounded financial strategy. Find your dream home, and worry about the interest rate later – you can always refinance, they say. But as a realtor who prioritizes working with you to determine what’s best, I can't help but cringe every time I hear it. I cannot tell you how many times I have heard this statement these past few years while continuously watching rates rise.

In today's market, where interest rates have been stubbornly hovering between 6 and 7%, focusing solely on the emotional pull of a property can lead to overlooking crucial financial realities. Here's why "marrying the house" with blind optimism about rates might not be the wisest move.

The Fickle Fate of Rates & Property Taxes:

While rates could dip again, it's a gamble. Are you comfortable basing a major life decision on an uncertain future? What if rates hold steady and property taxes and insurance continue to increase? Speaking from personal experience, my mortgage payment went up $120 a month last year due to increased property taxes.

Honesty and Affordability:

Here's the truth: rates might stay high, they might go down – no one really knows for sure. That's why focusing on affordability in the present is key. Can you comfortably swing the monthly payment at today's rates, with room for potential increases? If so, and homeownership aligns with your long-term goals, buying could be a great decision.

The Power of Smart Investment:

Affordability is key. If the current payment comfortably fits your long-term budget – real estate is an excellent investment. To me, owning real estate isn't just about a roof over your head; it's a strategic investment with significant potential. Think of it this way: Your down payment transforms from a checking account balance to equity in your property, essentially moving it to a different kind of account with amazing long term growth potential. View your down payment as equity, not a vanishing expense! And those monthly payments? They're building ownership, not just going towards rent. It's like putting money into a different kind of savings account, one that grows with your home's value! They become investments in your future, building equity that you can access when you sell or do a cash-out refi.

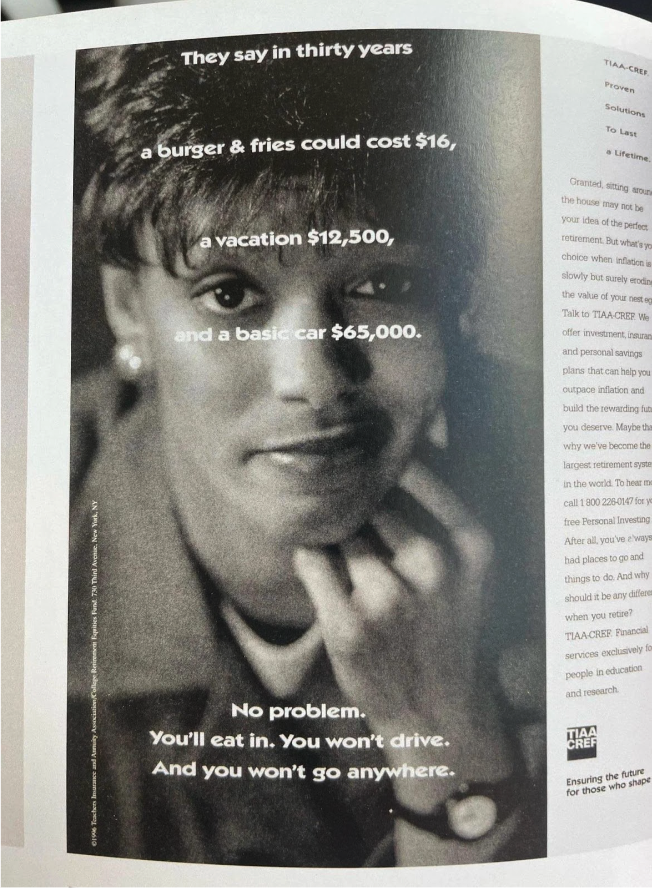

Let’s take a look at this ad from 1996.

And aside from the uncanny crystal ball predictions here, imagine in 30 years, the price of a home in your neighborhood could be $5 million. I will let you fill in the rest from here and end by saying, real estate has always been the best long term investment.

Beyond the Slogan:

“Marry the house, date the rate" is one major step in your evaluation of your home purchase and if rates do drop as we all hope, then what a great bonus! Real estate has the potential to be a significant long term investment, but securing it requires a strategic plan for the present. By crafting a customized purchase strategy that aligns with your budget, we can eliminate the risk associated with fluctuating interest rates and pave the way for a secure financial future.